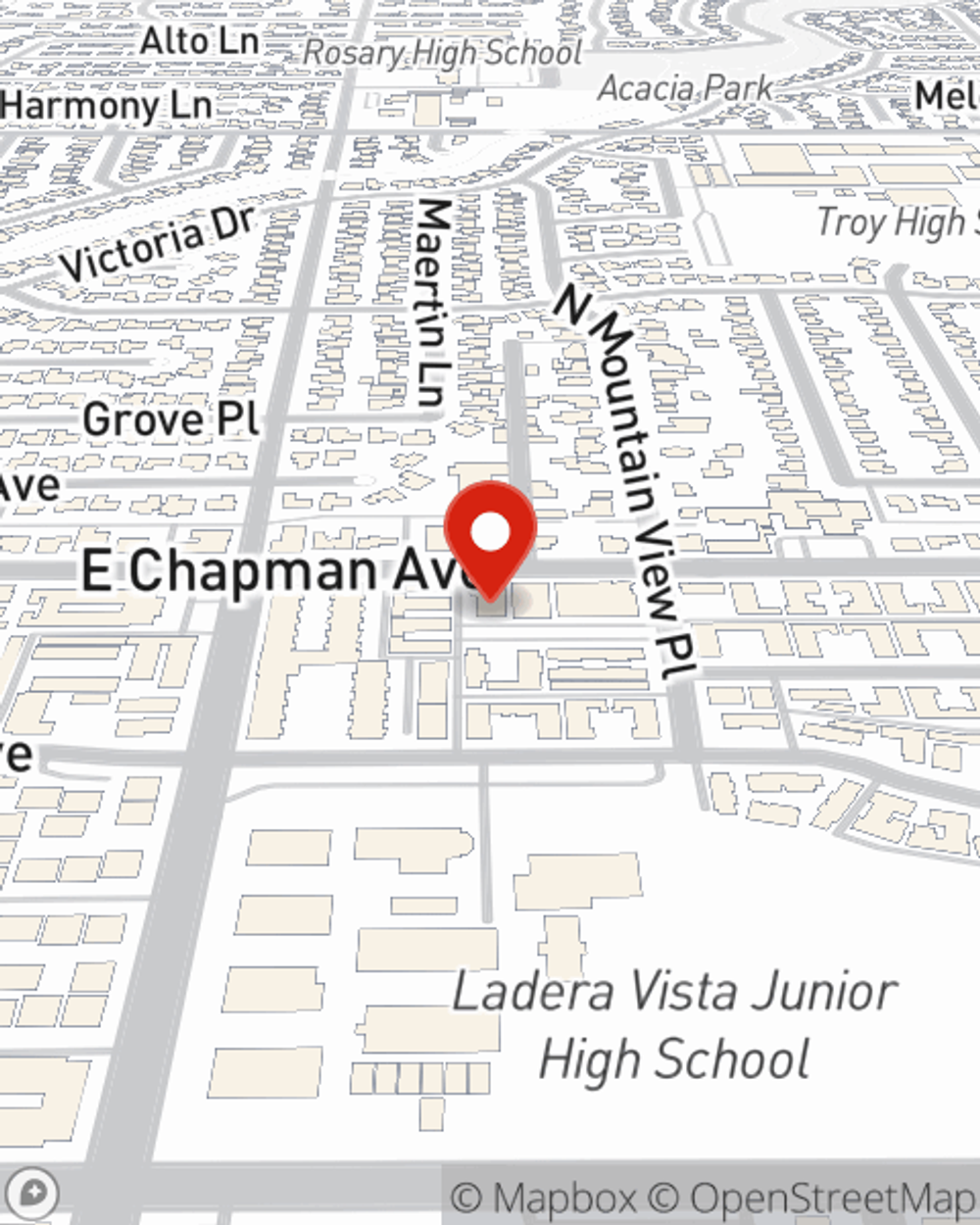

Business Insurance in and around Fullerton

Looking for small business insurance coverage?

Insure your business, intentionally

Cost Effective Insurance For Your Business.

It takes courage to start your own business, and it also takes courage to admit when you might need help. State Farm is here to help with your business insurance needs. With options like worker's compensation for your employees, extra liability coverage and business continuity plans, you can feel secure knowing that your small business is properly protected.

Looking for small business insurance coverage?

Insure your business, intentionally

Cover Your Business Assets

Whether you own a tailoring service, a veterinarian or a home cleaning service, State Farm is here to help. Aside from excellent service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Call Afshin Kangarlou today, and let's get down to business.

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Afshin Kangarlou

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".